Alright, let's cut the crap. You've seen the headlines, the rocket emojis o...

2025-10-25 19 ChainOpera AI

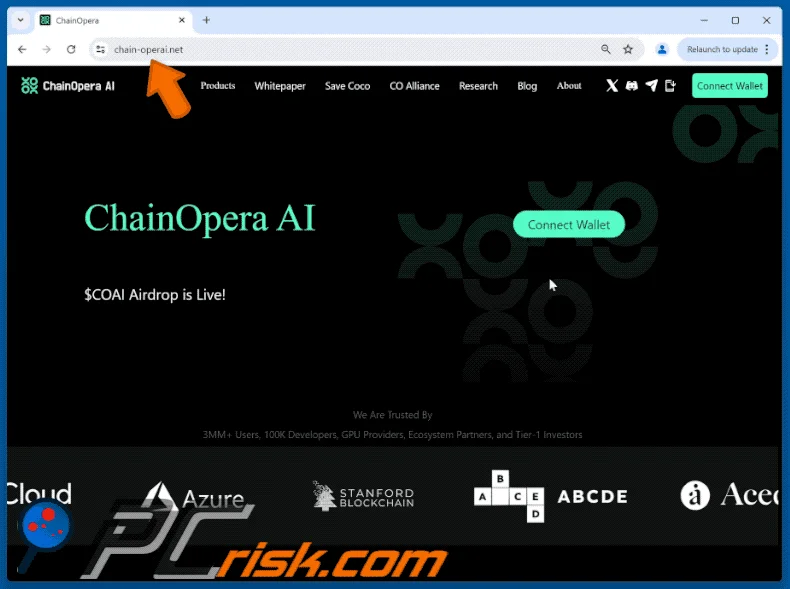

Every once in a while, a signal cuts through the noise so loudly it’s impossible to ignore. It’s not always a clean signal. Sometimes it’s messy, chaotic, and frankly, a little terrifying. The launch of ChainOpera AI ($COAI) was exactly that—a deafening roar of market energy that left analysts scrambling and skeptics screaming.

When I saw the numbers first scroll across my screen, I honestly just sat back in my chair, speechless. A 1,300% price surge in a week. A single-day trading volume of over $6 billion, at times eclipsing established giants like Solana and BNB. A market cap that shot past the billion-dollar mark almost overnight. This wasn’t a launch; it was a market supernova. And it all happened on the BNB Smart Chain, an ecosystem already humming with over $100 billion in daily futures trading.

This is the kind of explosive event that makes it easy to be cynical. It’s easy to point to the red flags—and believe me, they are there. But to dismiss this as just another speculative frenzy is to miss the profound message hidden within the chaos. We are witnessing a primal scream from the market for a new kind of AI.

Let’s be clear: the metrics are staggering. On September 25th, $COAI didn’t just enter the market; it detonated. It landed on major exchanges like Binance and Bybit, instantly tapping into a global river of capital. The project hit a Fully Diluted Valuation of over $4 billion—in simpler terms, that’s the theoretical market cap if every single token were in circulation today, a massive bet on its future.

ChainOpera AI claims this wasn't just speculative magic. They point to a real user base: over 3 million AI users, with a core of 300,000 who were already paying for their AI Terminal App using BNB. They say they successfully converted 40,000 of these existing users into active participants in the new token. That’s a crucial detail. It suggests that beneath the tidal wave of trading, there's a bedrock of genuine engagement. This isn't just about one token, it's about a groundswell of energy, a collective roar from the market that the centralized AI models of today aren't the final answer and people are willing to pour billions into even a hint of a decentralized alternative.

But this is where the picture gets complicated. The critics have a powerful, and not entirely wrong, argument, with many asking, What Are The Risks of Buying ChainOpera AI (COAI) in October? One X user laid it out bluntly: "If these wallets dump, the price could collapse to zero... This isn’t a real pump… it’s pure manipulation." And the on-chain data gives this warning teeth. An incredible 96% of the entire $COAI supply sits in the hands of the top 10 wallet addresses.

That is a terrifying concentration of power. It’s a lit fuse on a powder keg. So, are the critics right? Is this whole thing just a house of cards waiting for a stiff breeze?

Maybe. But what if we're asking the wrong question? Instead of just "Is this a bubble?", shouldn't we be asking, "What deep, unmet need is this billion-dollar signal pointing towards?"

Think of this moment not as a polished product launch, but as something more akin to the California Gold Rush. Was it orderly? No. Was it filled with charlatans, speculators, and outright scams? Absolutely. Did many hopeful prospectors lose everything? Tragically, yes. But that chaotic, messy, and dangerous stampede of humanity fundamentally changed the country. It was a raw, undeniable signal of immense, untapped value, and it pulled the future forward, kicking and screaming.

The $COAI launch feels like that. The extreme concentration of tokens is a massive design flaw, a glaring risk that speaks to the immaturity of the space. It’s a problem that needs to be solved. But the energy—the billions in volume, the viral attention—is the gold. It’s the proof that millions of people are desperately looking for a way to participate in the AI revolution on their own terms, outside the walled gardens of Big Tech.

The centralized AI we have today is brilliant, but it’s a cathedral built by a handful of high priests. We, the public, are merely the congregation. What projects like ChainOpera AI, flaws and all, represent is the hunger for a bazaar—a chaotic, decentralized, and open marketplace of intelligence where anyone can set up a stall.

This is the kind of breakthrough that reminds me why I got into this field in the first place. We have a moral imperative here. For the builders and visionaries in this space, the lesson from $COAI shouldn’t be how to engineer a better pump, but how to build a more robust, equitable, and truly decentralized foundation for AI. How do we harness this incredible market energy and channel it into something sustainable? How do we build systems that empower the many, not just enrich a few early wallets?

The future of intelligence is too important to be left in the hands of a few. The market, in its own wild and imperfect way, just screamed that sentiment to the entire world. We have to listen.

Let’s stop pretending that revolutions arrive neatly packaged and risk-free. They don’t. They are messy, volatile, and often look like pure madness in the moment. The explosion of ChainOpera AI isn't the revolution itself, but it’s the tremor that precedes the earthquake. It’s a flawed, imperfect, and dangerously top-heavy vessel, but it’s carrying a message of profound importance: the world is starving for a decentralized AI future, and it will pour its capital into anything that even hints at that promise. The real work starts now: building something worthy of that hope.

Tags: ChainOpera AI

Related Articles

Alright, let's cut the crap. You've seen the headlines, the rocket emojis o...

2025-10-25 19 ChainOpera AI