Mortgage Rates Fall: Hitting a One-Year Low, But What Does the Data Really Say?

The financial headlines are practically screaming with relief. "Average long-term US mortgage rate drops to 6.19%, lowest level in more than a year," one reads. On the surface, this looks like the first crack of light after a long, dark winter for the U.S. housing market. The narrative is simple: lower rates mean more affordability, more sales, and a return to normalcy.

But when you move past the headline number and into the structural data of the market, a very different picture emerges. This rate drop, while welcome, isn't the panacea it's being sold as. It's a minor tremor in a market that has been fundamentally reshaped by years of near-zero interest rates. The real story isn't about the people who can now afford to borrow at 6.19%; it's about the millions who are locked in at half that rate, and what their inertia means for everyone else.

The Illusion of Relief

Let's first dissect the number itself. The rate fell to 6.19% from 6.27% the previous week, marking the third consecutive weekly decline. For context, this is the lowest the 30-year average has been since October 3, 2024, when it registered 6.12%. This downward trend is, in part, a response to the Federal Reserve’s decision to cut its main interest rate last month, a move prompted by growing concerns over the U.S. job market.

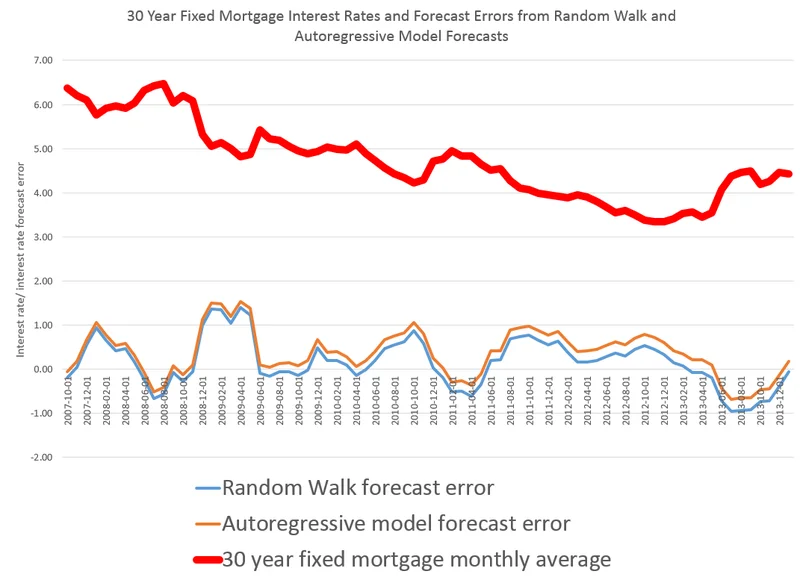

The market’s logic seems to be: Fed cuts rates, borrowing gets cheaper, housing recovers. It’s a clean, linear narrative. The problem is, it’s also demonstrably false. I’ve looked at hundreds of these data sets, and the correlation between the Fed funds rate and long-term mortgage rates is notoriously loose. We have a perfect case study from just last fall. After the Fed cut its rate for the first time in over four years, mortgage rates didn't fall—they marched steadily higher, eventually cresting above 7% in January of this year.

This tells us that mortgage rates are responding to a much broader set of signals than just the Fed’s short-term policy. They are slaves to the 10-year Treasury yield, which is itself a proxy for the market’s long-term expectations for growth and inflation. The current 10-year yield is hovering around 3.99%, not far off from where it was a week ago. This suggests the recent dip in mortgage rates is fragile, more a reflection of fleeting market sentiment than a durable policy-driven shift. A flare-up in the trade war or a single hot inflation report could easily reverse this trend. The market is giving with one hand, but it’s holding a take-back clause in the other.

The Golden Handcuffs Are Still On

The far more critical issue, however, is one of simple arithmetic. It raises the question many are asking: Mortgage rates are the lowest in a year. Should you refinance? The data on refinancing applications gives us a clue. According to the Mortgage Bankers Association, applications for refi loans now make up nearly 56% of all mortgage applications. This is being presented as a sign of life, but it’s a statistical head fake. The activity is coming from an incredibly shallow pool of homeowners: those who bought in the last two years when rates were even higher.

The real story lies not in who is refinancing, but in who is not. According to data from Realtor.com, approximately 80% of all U.S. homeowners with a mortgage have a rate below 6%. Digging deeper, the numbers get even more stark. Over half—to be more exact, 53%—have a mortgage rate below 4%.

Think about what that means. For the vast majority of American homeowners, a 6.19% rate isn't a bargain; it's a financial non-starter. They are living in homes financed at rates that may not be seen again in our lifetimes. This phenomenon, often called the "lock-in effect" or "golden handcuffs," is the single most dominant force in housing today. It's like a game of musical chairs where 80% of the players are glued to their seats. The music can change all it wants, but the game itself is frozen.

This is the core of the market’s dysfunction. The slump in home sales (last year saw the lowest level in nearly 30 years) isn't just a demand problem driven by high prices and rates. It's a supply problem of unprecedented scale. Potential sellers who would normally move for a new job, a growing family, or to downsize are staying put because moving would mean swapping a 3.5% mortgage for one that's nearly double. The result is a chronically starved inventory that keeps prices artificially high, canceling out any affordability gains from a modest dip in rates.

So, who is this 6.19% rate really for? It’s for the first-time homebuyer who has no choice but to accept the current terms. It’s for the desperate mover who must relocate for a non-negotiable reason. And it’s for the small cohort of recent buyers who can shave a percentage point off their loan. For everyone else (the overwhelming majority), it’s just noise. How far would rates have to fall to truly unlock the market and entice that sub-4% crowd to sell? And is it even possible to get there without causing some other, more severe form of economic dislocation?

A Statistical Mirage

The headlines are celebrating a number that has lost much of its meaning. A drop to 6.19% provides a psychological boost and marginal relief for a sliver of the market, but it does nothing to solve the fundamental problem. The housing market remains paralyzed by the lingering ghost of cheap money. Until rates fall to a level that can tempt the 53% of homeowners with sub-4% mortgages to sell, we are simply tinkering at the edges. This isn't a recovery; it's a rounding error. The real story isn't the current rate, but the anchor of past rates holding the entire market in place.

Tags: mortgage rates fall

Volvo's Best Trading Day Ever: Why It Happened and What It Signals for the Future

Next PostLuke Wilson Enters the AT&T vs. T-Mobile Ad War: What the Ads Are About and Why It All Feels So Off

Related Articles