Mortgage Rates Dip Below 6%: What This Drop Actually Means and If You Should Care

So, the number everyone’s been praying for finally flashed across their screens. 5.99%. I can almost picture it: some poor soul in a dimly lit room, doomscrolling Zillow for the 400th straight night, the pale blue light of their phone catching the desperation in their eyes as that number appears. For the first time in over a year, the average 30-year mortgage rate dipped below the big, scary 6%.

The internet, offcourse, is treating this like the heavens have parted. Financial news outlets are running breathless headlines like Mortgage Rates Today, Thursday, October 23: Finally Below 6% - NerdWallet. Real estate agents are probably firing off emails with subject lines full of champagne bottle emojis. "It’s a psychologically significant event!" they chirp.

Give me a break.

Calling this a "psychologically significant event" is like telling a man dying of thirst in the desert that you've found a single, lukewarm drop of water. Are we supposed to throw a parade because the cost of shackling yourself to a 30-year debt anchor is now just crushingly expensive instead of apocalyptically expensive? This isn't a victory; it's just a slightly less brutal beating.

The 5.99% Illusion

Let's be real. This whole obsession with the 6% threshold is a marketing gimmick. It’s a clean, round number that feels like a line in the sand, but it’s completely arbitrary. The difference between a 6.01% rate and a 5.99% rate on a $400,000 loan is, what, about five bucks a month? We’re not talking about a life-changing windfall here. We’re talking about the price of a fancy coffee.

And who are we even supposed to believe? NerdWallet says 5.99%, but CBS News, citing Freddie Mac, says the 30 year mortgage rates today are actually 6.19%. So which is it? Is the psychological barrier broken, or are we still staring at it from the wrong side? The fact that nobody can even agree on the number should tell you everything you need to know about the stability of this market.

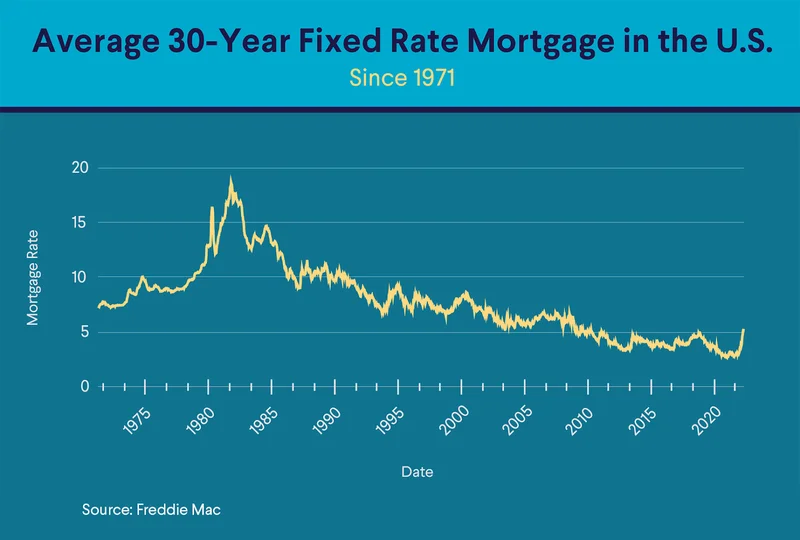

This is a bad sign. No, "bad" doesn't cover it—this is a five-alarm dumpster fire of conflicting data. We started 2025 with rates around 7%. So yes, 6-ish percent is better. But it’s still double what people were paying just a few years ago. We’ve become so accustomed to being fleeced that we celebrate when the fleecing is merely egregious instead of catastrophic. It’s like a form of financial Stockholm Syndrome. Is this really the new standard for "good news"? Are our expectations now so low that a minor dip in current mortgage rates feels like winning the lottery?

"Experts Say" is Code for "We Have No Idea"

Predictably, the "experts" have crawled out of the woodwork to offer their sage, and utterly useless, advice, with articles like Mortgage rates just dropped closer to 6%. Here's what buyers should consider now. - CBS News popping up everywhere.

"Don't wait for major, rapid declines," they warn. Translation: "Please, for the love of God, buy a house now. My commissions are drying up." This is just manufactured urgency. They’re trying to spark a little FOMO to get the market moving before the next inevitable rate hike.

Then there’s my favorite gem: homeowners with rates around 6.49% should "consider refinancing." You think? This isn't advice; it's just pointing out that water is wet. If you can get a lower rate on your refinance mortgage rates, you should probably take it. You don't need a PhD in economics to figure that out. It’s the kind of content-free fluff that fills up a webpage when the author has absolutely nothing new to say. Honestly, it reminds me of the generic user manuals you get with cheap electronics from China. Useless, but it fills the box.

The truth is, nobody knows what the Federal Reserve is going to do next week. They might cut rates by another 25 basis points. They might hold steady. They might see a squirrel outside the window and decide to raise them just for kicks. It ain't a predictable science, but it's treated like some dark art only the Wall Street wizards can decipher. Anyone who tells you with certainty what will happen to interest rates today or tomorrow is either a liar or a fool.

They want you to make the single biggest financial decision of your life based on a coin flip, and honestly...

Flying Blind in a Broken System

Here’s the part that really gets me. The part that turns this whole situation from a standard market fluctuation into a complete farce. The government has been shut down. You know, that thing that happens when the adults in Washington can't agree on a budget and decide to take their ball and go home. Because of this little temper tantrum, crucial economic data—like the September jobs report and the consumer price index—has been delayed.

Let me put this in simpler terms. The people telling you it’s a good time to buy a house are doing so with a giant, gaping black hole where the most important economic information should be.

This is like a pilot coming over the intercom and saying, "Folks, we’re beginning our descent. Our navigation system is down, we have no idea what the weather is like at the destination, and we've lost contact with the control tower. But I’ve got a pretty good feeling about this!" Would you feel confident in that landing? Would you be unbuckling your seatbelt and getting ready to applaud? Then why would you sign a 30-year contract on a home mortgage rate under the exact same circumstances?

The market has been a rollercoaster for years. Rates hit a low, everyone gets excited, then they spike again. It’s a casino, and right now, the house is telling you to bet big while admitting they’ve turned off all the cameras and can’t see the cards. This isn’t just volatility. "Volatility" is too clean a word for this. This is a system having a seizure, and we’re all just supposed to pretend the twitching is a new dance craze.

Then again, maybe I'm the crazy one. Maybe locking in a 5.99% rate in a completely blind market really is the smartest move you can make.

So We're Supposed to Be Grateful?

Don't let them fool you. This isn't a recovery. This isn't a sign that things are "getting back to normal." This is a crumb. It's a calculated little piece of bait dropped into the water to see if the fish are still hungry. The fundamental problems—houses that are absurdly overpriced, wages that haven't kept up, and a government that can’t even be bothered to release the damn jobs report—are all still there. This 5.99% rate is a distraction, a shiny object to look at while the structural rot continues to spread. Enjoy the moment of relief if you must, but don't you dare mistake it for hope.

Tags: mortgage rates today

Just Another SpaceX Launch: What Time, Where to Watch, and If You Should Even Bother

Next PostRivian Layoffs: CEO Praises Chinese EV While Firing Hundreds

Related Articles