P&G's Earnings Beat: What the Numbers Reveal About Consumer Demand and the Stock's Future

In a world obsessed with disruption, we’ve forgotten the profound genius of stability. We chase the meteoric rise of AI startups and quantum computing ventures, our eyes glued to the tickers that promise to change everything overnight. We celebrate the brilliant, volatile flame. But we ignore the steady, powerful engine humming quietly in the background—the systems that actually hold our daily lives together when everything else seems to be flying apart.

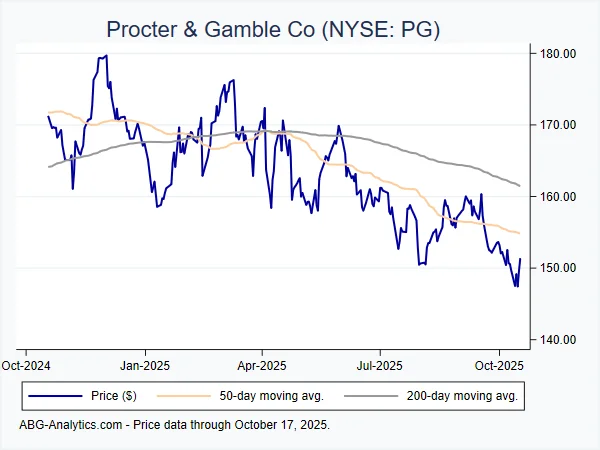

Last week, Procter & Gamble, a company many would dismiss as a relic of a bygone era, released its quarterly earnings. On the surface, it was just another financial report. Adjusted earnings per share of $1.99, beating the $1.90 Wall Street expected. Revenue of $22.4 billion, a hair above estimates. The stock got a little bump. Most of the market shrugged and went back to chasing unicorns. But I think they missed the real story. When I saw these numbers, set against the backdrop of what CEO Jon Moeller rightly called a “challenging consumer and geopolitical environment,” I honestly just sat back in my chair, speechless. Because this wasn't just a financial beat. It was a data point proving the power of a different kind of technology—the technology of resilience.

The Unbreakable System

Let’s be honest. Nobody gets excited about Tide pods or Gillette razors. They are the definition of mundane. But think for a moment about the sheer, staggering complexity of what it takes to get those products onto a shelf in your local store, reliably, every single day, in virtually every country on Earth. It means navigating tariffs, managing commodity price swings, predicting consumer behavior across cultures, and operating a supply chain so vast it’s practically a planetary circulatory system. This is the kind of breakthrough that reminds me why I got into systems analysis in the first place—it’s a global-scale logistical masterpiece that makes our modern lives possible, and it’s a system that just proved, with hard numbers, that it can withstand immense pressure.

P&G’s revenue grew 3% in a climate where many companies are just trying to stay afloat. Every single one of its divisions grew, with Beauty leading the way at 6%. What does that tell us? It tells us that even when the world feels uncertain, people crave normalcy. They seek out the small, tangible comforts of a trusted brand. This isn't just about consumerism; it's about a deep, human psychological need for reliability.

This system is like a decentralized network protocol, but for physical goods. It's built with so much redundancy and institutional knowledge that it can absorb shocks—geopolitical turmoil, new tariffs, shifting costs—and still deliver. It’s a self-healing mesh of production, distribution, and marketing. In simpler terms, it’s a promise, encoded in a bar of soap, that some things will just work. Is that not a form of technology? What if the most advanced innovation isn't a faster chip, but a system that guarantees a family can get diapers and toothpaste during a global crisis?

The Human Algorithm of Trust

Now, I know what the skeptics will point to. They’ll see headlines about insiders like the CFO and COO selling off significant chunks of their shares in the months leading up to this report. They’ll see that institutional investors are a mixed bag, with many trimming their positions, such as the case of Procter & Gamble Company (The) $PG Shares Sold by GLOBALT Investments LLC GA. The conventional wisdom says that’s a red flag—the people on the inside are losing faith.

But I see something else. I see a classic case of mistaking the share price for the value of the system. Those transactions are financial calculations based on market timing and personal portfolio management. They are moves within the game. But they don't reflect the fundamental strength of the underlying asset, which isn't just factories and patents, but a century of accumulated consumer trust. That trust is an algorithm more powerful than any code written in Silicon Valley. It’s an algorithm that runs on human emotion, memory, and the simple satisfaction of a product that does what it says it will do.

What the short-term traders and even some of the insiders might be missing is that P&G’s real value isn’t in its next quarterly growth percentage. It’s in its function as a societal stabilizer. This is the modern equivalent of the Roman aqueducts—the essential, unglamorous infrastructure that allows the empire of our globalized world to function. The stock may fluctuate, but the system endures. So, are the insiders truly signaling a lack of confidence in the company, or are they simply underestimating the profound, long-term value of the very machine they help operate? When you’re focused on the cogs, do you sometimes lose sight of the clock’s purpose?

The market’s reaction suggests a glimmer of this understanding, as Bulls Flock to Procter & Gamble Stock After Upbeat Results. They’re betting on near-term upside, but the real bet should be on long-term indispensability. In an age of digital ephemera and fleeting loyalties, P&G has built something tangible and lasting. It’s a quiet giant, and its latest earnings report wasn’t a roar, but a steady, powerful heartbeat.

Resilience Is the New Disruption

We spend so much time looking for the next paradigm shift that we fail to appreciate the one we’re living in. The true revolution isn’t about breaking things; it’s about building things that don’t break. In a future defined by volatility and uncertainty, the most valuable asset won’t be speed or novelty, but resilience. The ability to deliver, to endure, to be trusted—that is the ultimate competitive advantage. P&G’s boring, beautiful, unbreakable system just proved it.

Tags: pg stock

The Citi Strata Elite Launch Fiasco: The 4506-C Mess and Citi's 100K Point 'Fix'

Next PostAster's Market Turmoil: Decoding the Price Crash and Finding the Real Breakthrough

Related Articles