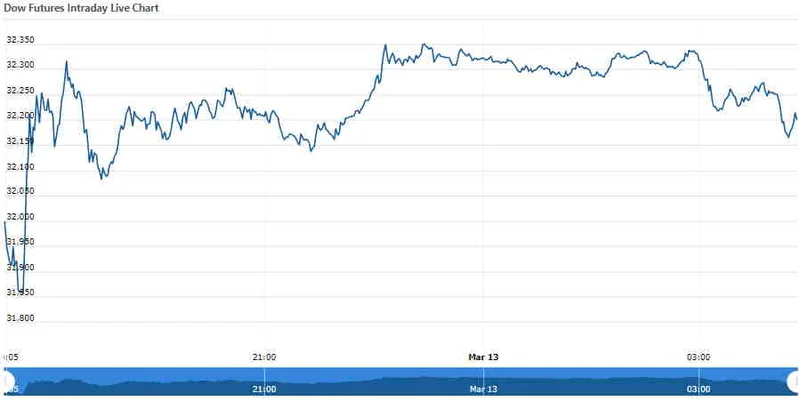

Dow Futures' Latest Mood Swing: What's Really Happening vs. What They're Selling You

So, let's get this straight. The market spent four days climbing a mountain of hopium, fueled by whispers of a US-China "trade deal framework" and the collective prayer for another Fed rate cut. Everything was green. Bitcoin was mooning. Dow futures were soaring. It felt like 2021 all over again, and everyone was getting ready to print their "I'm a genius" t-shirts.

And then Jerome Powell walked up to a microphone and cleared his throat.

That’s all it took. One guy, in one press conference, uttered five little words—"far from it"—and the entire house of cards started to wobble. The Dow snapped its winning streak, the S&P 500 flatlined, and the bond market had a full-blown panic attack. As one headline summarized the damage, the Dow closes lower, giving up gain after Powell signals Fed may not cut again this year. Billions of dollars in "value" vanished into thin air because a man in a suit used a slightly stern tone.

Give me a break. This isn't investing; it's a high-stakes game of Simon Says, and we're all just watching the players who trip over themselves. Are we really supposed to believe this system is built on sound fundamentals and rational analysis? Or is it just a casino where the croupier can change the rules by adjusting his inflection?

The Free-Money Sugar Rush

Before the inevitable crash, the mood was, as one analyst put it, "buoyant." I'd call it delusional. The catalyst was a headline claiming Dow Jones Futures Surge as US-China Trade Deal Framework Fuels Market Optimism. Let's deconstruct that, shall we? A "framework" for a "potential" deal. That’s like saying you have a "plan" to "consider" asking someone on a date. It means absolutely nothing. It's a press release masquerading as progress.

But the market, in its infinite wisdom, ate it up. The Nasdaq gained, the S&P was on its way to another record, and even crypto got in on the action. Bitcoin surged past $115,000. Why? Because when the free-money music is playing, you don't ask questions. You just dance.

This whole spectacle is like watching a toddler who's been fed a diet of pure sugar for a week. The kid is bouncing off the walls, screaming with joy, convinced this feeling will last forever. The "trade deal framework" was another lollipop. The expectation of a Fed rate cut was a giant slice of cake. The market was that toddler, giddy and high on the promise of more cheap money. The Magnificent Seven were leading the charge, because offcourse they were. When the tide of cheap capital rises, it lifts the biggest yachts first.

But what happens when the sugar rush ends? What happens when a responsible adult walks into the room and says it’s time for a nap?

And Then Dad Came Home

Enter Jerome Powell. He didn't even have to yell. He just had to hint that the party might be ending soon. He said a December rate cut was "not a foregone conclusion. Far from it."

That "far from it" part was the cold bucket of water. One analyst called the phrase "unnecessary, and heavily loaded." Unnecessary? No, 'unnecessary' doesn't cover it—it was a deliberate kill shot. Powell knew exactly what he was doing. He saw the irrational exuberance, the market pricing in cuts that were never guaranteed, and he decided to pop the balloon. You could almost hear the collective gasp on the trading floor as algorithms processed those five words and started selling everything that wasn't nailed down.

The rally didn't just fizzle; it hit a brick wall. The gains evaporated in the last hour of trading. It’s a classic move, really. The market gets high on its own supply, the Fed comes in to play the heavy, and everyone acts shocked. Shocked!

I mean, I can't even get a straight answer from my ISP about why my internet is slow, but these Wall Street gurus think they have the global economy mapped out to the decimal point based on a single press conference. And when they get it wrong, they blame the Fed for being a buzzkill. It ain't the Fed's fault. It's the fault of a system that rewards gambling over building, speculation over substance. Does anyone even know what these companies do anymore, or do they just know the ticker symbol and the direction it's supposed to go?

The most telling reaction wasn't even in stocks. It was the bond market. The 10-year Treasury yield saw its largest gain on a Fed day this year. For the non-finance nerds, that’s the smart money running for the exits. While the stock market is having a tantrum, the bond market is quietly preparing for a storm. And when those two signals diverge, you better pay attention to the one that isn't throwing a fit on national television. Because this whole thing, this entire rally and subsequent collapse...

This Is All Just a Game

Let's be brutally honest. What we witnessed wasn't a sophisticated re-evaluation of macroeconomic conditions. It was a mood swing. A global, multi-trillion-dollar mood swing. The market isn't a finely tuned machine; it's a deeply insecure teenager, desperate for approval from the Federal Reserve. When Powell hints at giving it a bigger allowance (rate cuts), it's euphoric. When he threatens to ground it (holding rates steady), it throws a fit and slams the door.

None of this is real. The "value" that was created by a vague trade headline was just as imaginary as the "value" that was destroyed by a five-word phrase. It’s all just numbers on a screen, driven by fear and greed in a feedback loop so tight it’s choking on its own tail. We're supposed to tether our retirements, our mortgages, and our economic future to this? A system that can be sent into a tailspin because one guy chose his words a little too carefully? It’s madness. And the worst part is, tomorrow, they'll wake up and do it all over again.

Tags: dow futures

Big Tech's Latest Mess: The latest AI news and what Apple & OpenAI are actually doing

Next PostBig Tech's Market Correction: Why This Is the Reset Innovation Needed

Related Articles