Solar Leases: A Ray of Hope for North Carolina? Okay, folks, buckle up, bec...

2025-11-06 20 solar incentives

The Hawaiian Islands, famed for their sunshine, face an ironic problem: the potential collapse of their solar industry. A federal tax credit, a key driver of rooftop solar adoption, is ending prematurely, threatening the economics of clean energy in a state already grappling with sky-high electricity costs. The question isn't whether Hawaii can save its solar industry, but whether its lawmakers will act decisively enough.

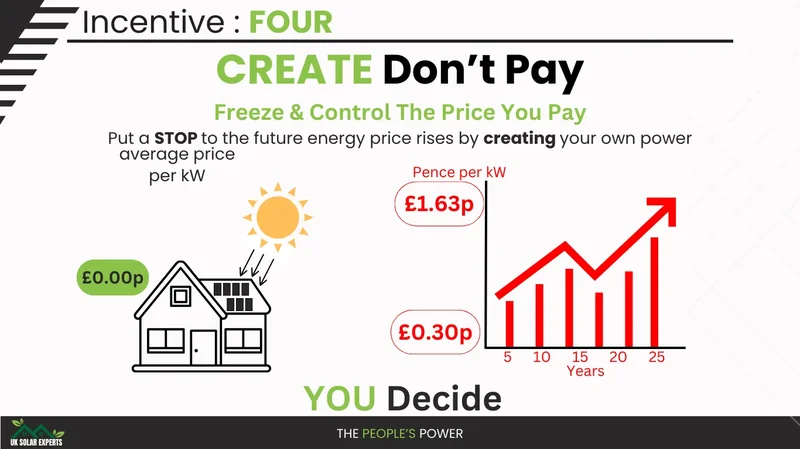

Hawaii's electricity rates are, frankly, absurd. At 43 cents per kilowatt hour on Oʻahu, residents pay more than 2.5 times the national average. Solar offered a lifeline, especially when combined with the state's 35% tax credit (capped at $5,000). A typical $15,000 system could drop to $5,700 out-of-pocket. But starting in 2026, that same system jumps to $10,000 – a 75% increase. This isn't just about individual savings; it's about the viability of an entire industry.

The impact is already being felt. Installers report a surge in applications as homeowners scramble to beat the deadline. Rocky Mould, executive director of the Hawaii Solar Energy Association, put it bluntly: without the federal credit, the industry will be hit with a “sledgehammer.” Layoffs and business closures are anticipated. Smaller companies, lacking diversified revenue, are most vulnerable.

Hawaii's ambitious goal of 100% clean electricity by 2045 hinges on rooftop solar. Each new solar home reduces grid stress and dependence on imported fossil fuels. Currently, the state imports virtually all its petroleum. The federal tax credit wasn't a handout; it was a strategic investment in energy independence. Now, that investment is being yanked away.

The state legislature has options. First, protecting the existing 35% state solar tax credit is crucial. Proposals to reduce or eliminate it must be rejected. (House Bill 1369, introduced earlier this year, aimed to repeal it outright.) In fact, the legislature should consider increasing the credit to partially offset the federal loss.

Second, reinstating and expanding a direct rebate program for low and middle-income households, funded by the barrel tax, is essential. The environmental response, energy, and food security tax currently generates about $27 million annually. Allocating a portion – perhaps $10 million per year – for direct rebates of $3,000-$5,000 for households earning below 140% of area median income would democratize access to solar. Unlike tax credits, which only benefit those with tax liability, rebates would help renters and lower-income families.

Third, streamlining permitting and interconnection processes is vital. If financial incentives weaken, reducing bureaucratic friction is the next best lever. Every unnecessary delay adds costs to installations.

The barrel tax mechanism is particularly elegant. It taxes the problem (fossil fuel imports) to fund the solution (clean energy adoption). As solar adoption grows and gasoline use declines, barrel tax revenues will naturally diminish. But by then, Hawaii will have built substantial renewable capacity.

Some legislators may balk at "subsidizing" solar. This is a flawed perspective. Supporting residential solar is an investment in energy infrastructure. Every kilowatt of solar capacity installed today is a kilowatt Hawaii won't need to generate from expensive imported oil tomorrow. Homeowners cover the capital costs; taxpayers share in the savings through reduced energy imports.

Moreover, the economic multiplier effects are significant. Solar installation creates local jobs, keeps energy dollars circulating in Hawaii's economy, and reduces long-term electricity costs. These benefits outweigh the foregone tax revenue.

North Carolina, another state with a growing solar industry, faces similar challenges. The expiration of the federal tax credit has spurred innovative solutions. EnerWealth Solutions, a Durham-based company, buys rooftop solar panels with the tax credit still available to commercial entities and rents them to homeowners, passing along the savings. This leasing strategy could be a model for Hawaii. One North Carolina company’s plan for keeping rooftop solar going

North Carolina, despite being a sunny state, is only middling in residential solar adoption, with just over 55,000 homes equipped with rooftop panels. This suggests ample room for growth, but also the need for creative policies to overcome financial barriers.

Duke Energy, North Carolina's predominant electric utility, has even launched a trial program called PowerPair, offering rebates of up to $9,000 for customers investing in a battery along with a solar array. This demonstrates that utilities can play a positive role in promoting residential solar.

Hawaii's situation is a microcosm of the broader challenges facing the clean energy transition. The end of federal incentives is a setback, but it also presents an opportunity for states to step up and demonstrate leadership. The question isn't just about saving Hawaii's solar industry; it's about ensuring that clean, affordable energy is accessible to all.

Mitchell Schwartz, founder of the Jewish Solar Challenge (an initiative to get solar panels on Jewish non-profits), noted that solar panels cost less than half of what they did in 2010, while producing nearly twice as much energy. He claims that solar panels build critical financial resilience, stabilizing budgets and protecting programs as philanthropy dollars fluctuate. Jewish philanthropy should back solar for nonprofits, even after incentives end

The federal government's decision to terminate the solar tax credit early is a short-sighted move. It undermines years of progress and jeopardizes Hawaii's clean energy goals. The surge in applications before the deadline proves that financial incentives work. The real question is whether Hawaii's lawmakers will recognize the magnitude of the crisis and act decisively to avert it. It’s not just about economics; it’s about resilience, sustainability, and the future of the islands.

Tags: solar incentives

Related Articles

Solar Leases: A Ray of Hope for North Carolina? Okay, folks, buckle up, bec...

2025-11-06 20 solar incentives