Cook County Property Tax: Decoding Your Bill, Due Dates, and Exemptions

Beyond the Bill: How AI Can Transform Cook County Property Taxes from Dread to Delight

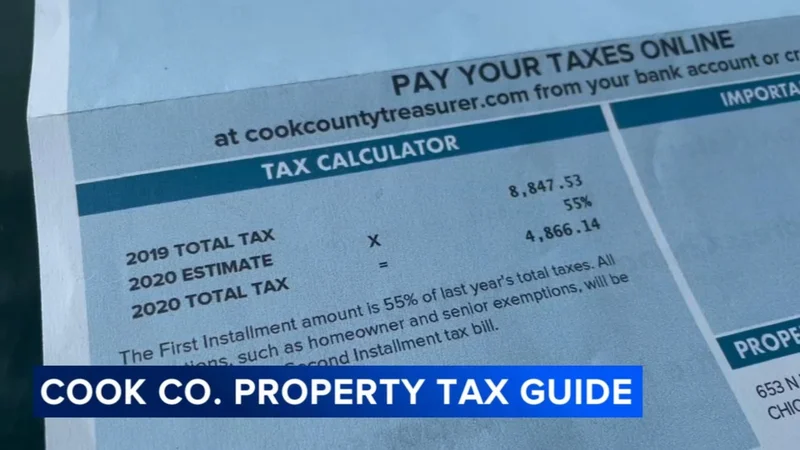

Let’s be honest. For many of us, the phrase "property tax bill" conjures a familiar knot in the stomach. It’s not just the number staring back at you; it’s the opaque process, the looming `cook county property tax due dates`, the scramble to figure out `when is cook county property tax due`, and that inevitable moment of panic around the `cook county property tax second installment`. We’re living in an era of instant information, yet something as fundamental as our property taxes often feels stuck in the past, shrouded in paper and bureaucratic mystery. But what if it didn't have to be this way? What if we could flip the script entirely, moving from reactive dread to proactive, personalized empowerment?

My friends, I envision a future where the `cook county property tax bill` isn't a surprise attack, but a transparent, understandable, and even predictable part of your financial life. This isn't just wishful thinking; it's a tangible outcome within reach if we embrace the power of smart systems. When I think about the current system, I honestly just shake my head, thinking, "We can do so much better!" We're talking about a paradigm shift, a true breakthrough in civic engagement powered by the very technologies we use every day. Imagine a world where your property tax journey is less like navigating a labyrinth blindfolded and more like having a personal financial co-pilot.

From Paper Trail to Predictive Power: Rethinking the Tax Landscape

The current system, let's call it "Bill-Shock-as-a-Service," is fundamentally reactive. You wait for the `cook county property tax bills` to be mailed, often wondering exactly `when will cook county property tax bills be mailed`, then you react. You might do a `cook county property tax search` online, only to find a clunky interface that requires a detective's persistence. It’s a process built on friction, designed for compliance rather than clarity. A recent, somewhat cynical local headline I saw bemoaned, "Cook County Homeowners Brace for Another Round of Tax Confusion." But what if we could reframe that? What if we could replace confusion with confidence?

Think about it like this: right now, dealing with property taxes is like trying to navigate a complex city with only a paper map from the 1990s. You're constantly looking over your shoulder, hoping you don't miss a turn or, worse, a `cook county property tax due date`. But we have GPS now, right? We have real-time traffic updates, predictive routing, and personalized recommendations. Why can't our civic systems offer the same? The speed of this potential transformation is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend, and we can choose to be on the leading edge! We're not just talking about digitizing paper; we're talking about intelligent digitization. This uses predictive analytics—in simpler terms, it means using historical data and complex algorithms to forecast future outcomes—to anticipate your needs before you even know you have them.

A Vision for Tomorrow: Your Proactive Financial Co-Pilot

Imagine a future where you receive a personalized notification weeks, even months, before your `cook county property tax second installment 2025` is due. Not a generic email, but a smart alert detailing your specific assessment, highlighting potential `cook county property tax exemption` opportunities you might qualify for, and even providing a personalized breakdown of where your tax dollars are going. We’re talking about an intuitive dashboard that shows you, with crystal clarity, exactly what contributes to your `cook county property tax bill`, what your projected `cook county property tax due dates 2025` are, and how to easily apply for any relief.

This isn't just about convenience; it's about empowering homeowners. It's about shifting from a system that often feels like an adversary to one that genuinely serves its citizens. This kind of transformation, much like the advent of the printing press democratized knowledge, could democratize financial understanding for every homeowner. Of course, with great power comes great responsibility. We'd need robust safeguards for data privacy and ensure equitable access for all citizens, regardless of their tech literacy. But the potential for good is immense. What kind of civic infrastructure would we need to build to support such a system? And how do we ensure transparency in the algorithms themselves?

I often scour online forums, and I saw a comment on a local Reddit thread the other day that truly resonated with me. Someone wrote, "If my bank can tell me when I'm overspending, why can't Cook County tell me if I'm about to miss a tax deadline or if there's a new rebate I qualify for? That's the dream!" And you know what? That is the dream. It’s a dream built on the very technologies that are reshaping our world right now. We have the tools; it’s time to apply them where they can make the biggest human impact.

The Future of Fiscal Clarity is Here, If We Choose It

Tags: cook county property tax

CRCL Stock: What the Future Holds and Why It Matters

Next PostTax: Property, Income, and 2025 Tax Brackets

Related Articles