EVAA Protocol's Parabolic Rise: A Look Beyond the Telegram Hype In a market...

2025-10-28 23 EVAA Protocol

Alright, let's cut the crap. Every time a new token chart goes vertical, my inbox floods with the same breathless question disguised as a news tip: "Have you seen [INSERT COIN NAME HERE]?" This week's star is EVAA Protocol. It’s up 189% in seven days. The trading volume is exploding. And the official "community sentiment" is, I kid you not, "100% bullish."

One hundred percent.

You have to admire the audacity. Not 99%, not 98%. A perfect, utopian consensus where every single person involved is convinced this thing is going to the moon. It reminds me of those old-timey medicine shows where a guy in a top hat sells snake oil that cures everything from baldness to a broken heart, and the first ten people in the crowd are his cousins. Who are they polling for this "100%" figure? Is it a survey of two guys who just 10x'd their lunch money? Or is it just the marketing department throwing a number at the wall to fuel the FOMO engine?

This isn't investing; it's a fever. And I've seen this fever before. It's a high-stakes digital gold rush, and everyone's convinced they're the one who'll find the nugget, not the one who'll be left holding a bag of dirt when the music stops.

So, what are people actually buying? On paper, EVAA is another cog in the Decentralized Finance (DeFi) machine, living on the BNB Chain. It’s traded on real exchanges—Gate.io, PancakeSwap, a few others. It has a functional website and a contract address that isn't a complete scam on its face. The price is hovering around $9.70, with a 24-hour trading volume of $83 million. These are real numbers.

But numbers without context are just noise. And the context here is what should be setting off alarm bells in your head.

The whole thing is like a brand-new nightclub with a massive line out front. From the street, it looks like the hottest ticket in town. Everyone is desperate to get in. The bouncer (the price chart) is only letting people in for a higher and higher cover charge. But what if the inside is mostly empty, and the line is just for show? The hype itself becomes the product. People aren't buying EVAA because they've pored over its whitepaper and believe in its long-term utility; they're buying it because it's going up. Full stop.

And when that's the only reason, how long can the party possibly last? What happens when the first few people at the front of the line decide to cash out and go home?

Here's the part where the record scratches and the lights flicker on. The part that separates the suckers from the skeptics.

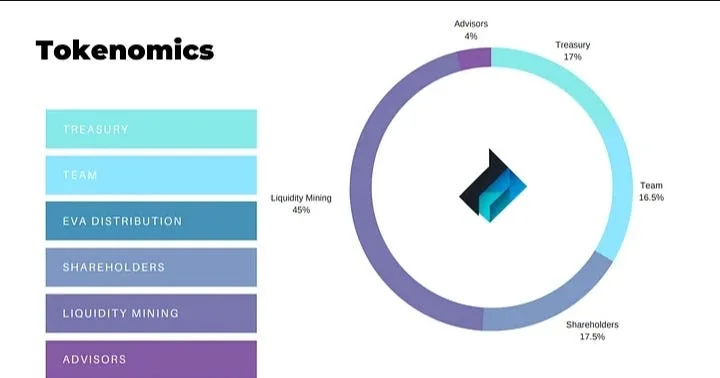

According to data from EVAA Protocol Price: EVAA Live Price Chart, Market Cap & News Today - CoinGecko, EVAA has a circulating supply of about 6.6 million tokens. The total—and maximum—supply is 50 million. You don't need to be a math genius to see the problem. Roughly 87% of all EVAA tokens that will ever exist are not currently on the market. They're sitting somewhere in a digital vault, held by the project's founders, early investors, or "treasury."

This is a bad sign. No, "bad" doesn't cover it—this is a five-alarm dumpster fire of a red flag.

It's like playing a game of poker where the dealer is holding 80% of the cards and can decide to deal them into the game whenever he feels like it. You and the other players are bidding up the value of the few chips on the table, while the house sits on a mountain of them, waiting for the price to get high enough. When they finally decide to sell, what do you think happens to the value of your chips? It ain't going up, I can tell you that.

They’ll tell you those locked tokens are for "long-term ecosystem health" or "future development," and maybe they even believe it. But the temptation to dump a few million tokens into a frenzy of retail hype must be astronomical. Offcourse, I'm sure they have the strongest willpower. Then again, maybe I'm the crazy one here. Maybe this time it's different.

But it's never different, is it?

Look, I'm not a financial advisor, and this isn't advice. It's a reality check. Could EVAA go up another 200%? Absolutely. Hysteria is a powerful force. But you have to ask yourself one question: are you investing in a revolutionary DeFi protocol, or are you just providing the exit liquidity for the people who got in before you? Because from where I'm sitting, that "100% bullish" sentiment looks a lot like the cheering from the deck of the Titanic. It sounds great, right up until the very end.

Tags: EVAA Protocol

Related Articles

EVAA Protocol's Parabolic Rise: A Look Beyond the Telegram Hype In a market...

2025-10-28 23 EVAA Protocol