Alright, let's cut the crap. Every time a new token chart goes vertical, my...

2025-10-26 29 EVAA Protocol

In a market stained red, one asset painted a starkly different picture. Picture a trader’s screen, a sea of flickering crimson numbers, and then, a single, defiant green line shooting vertically upwards. That line was EVAA Protocol. While the broader crypto market was uncertain, EVAA’s price didn’t just hold steady; it exploded to a new all-time high of $7.94, and then pushed past $10.

This kind of outlier behavior demands scrutiny. When an asset violently decouples from the market, it’s either a signal of profound underlying strength or a symptom of a narrative-fueled fever. The data suggests the latter. EVAA Protocol’s story is a fascinating case study in the power of distribution, but it also raises critical questions about whether its valuation has outrun its fundamentals.

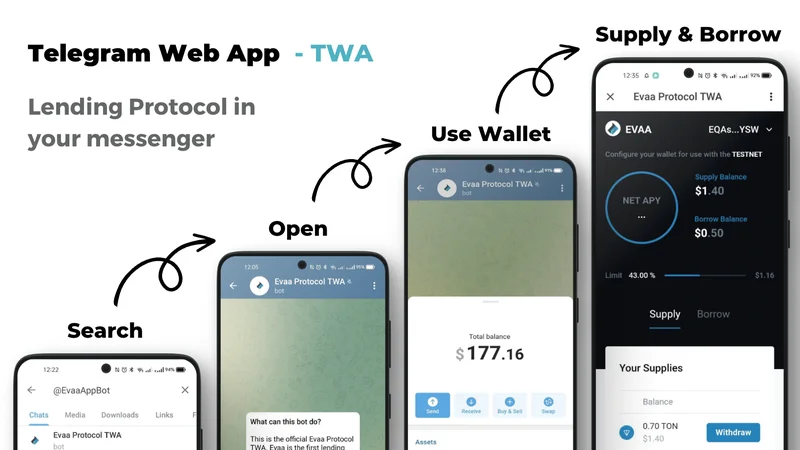

The core narrative is undeniably potent. EVAA is a DeFi lending protocol built on the TON blockchain with a killer feature: it's fully integrated into Telegram as a Mini App. This isn't just another DeFi protocol languishing on a hard-to-access chain; it’s a financial service embedded directly within a messaging app boasting hundreds of millions of users. It’s like building a full-service bank branch not near a busy intersection, but directly inside the turnstiles of Grand Central Station. The potential for user acquisition is immense, removing the friction that plagues most of DeFi. Why bother with browser extensions and seed phrases when you can lend and borrow from the same app you use to text your friends?

This strategy appears to be working, at least on the surface. The project boasts some impressive top-line numbers: over $1.4 billion in cumulative transaction volume and 300,000 wallets created since its 2023 inception at a hackathon. But as an analyst, these are precisely the kinds of vanity metrics that set off my internal alarms. What does "cumulative transaction volume" actually represent? Is it a measure of genuine economic activity, or is it inflated by users cyclically borrowing and lending the same capital to farm rewards? And what about those 300,000 wallets? How many are truly active, and how many were created to chase an airdrop and now lie dormant? Without data on user retention and net protocol revenue, these figures are more marketing than metric.

The disconnect becomes more apparent when we juxtapose the protocol's financial state with its token's price action. EVAA Protocol recently raised $2.5 million in a private token sale from a respectable list of VCs (including Animoca Ventures and CMT Digital). This is a solid seed-stage accomplishment. Yet, shortly after, the token’s market cap soared to $68.4 million with a daily trading volume of $77.6 million.

Let’s pause on that for a moment. The 24-hour trading volume exceeded the entire market capitalization of the project. I've analyzed hundreds of token launches, and while high volume-to-market-cap ratios are common in early, speculative phases, this level suggests a market driven almost entirely by short-term traders, not long-term investors valuing the protocol's cash flows. It’s a classic momentum trade, fueled by trending lists like Top Trending Cryptocurrencies on CoinGecko: $EVAA, $GIGGLE, and $VIRTUAL Lead the Pack, where EVAA sat at the top with a seven-day gain of over 200%—to be more exact, 211.3%.

This isn't a critique of the team or the technology itself. CEO Vlad Kamyshov’s vision of creating a "liquidity layer for Telegram" is compelling. The recent launch of the EVAA token and the transition to a DAO is a standard, and often successful, playbook for decentralizing governance and incentivizing community participation. Token holders can vote on protocol parameters, share in revenue through buy-backs, and receive fee discounts. These are all sound mechanics.

But mechanics are not a business model. The fundamental question remains: how much real, sustainable revenue can the protocol generate? Lending protocols make money on the spread between what they pay depositors and what they charge borrowers. Is there sufficient organic borrowing demand on the TON network to justify a nearly $70 million valuation and turn EVAA into a profitable, self-sustaining entity? The recent price action isn't based on an answer to that question. It’s based on a bet that millions of Telegram users will seamlessly convert into active DeFi users. That’s a powerful story, but it’s still just a story.

The technical analysis reflects this speculative fervor. Price charts show the token breaking out of an ascending channel and entering an impulsive "wave three," which is typically the most aggressive phase of a rally. Analysts are pointing to Fibonacci extension levels at $8.95 and $10.90 as the next targets, a point made in analysis like EVAA Protocol (EVAA) Price Hits New All-Time High Despite Crypto Market Dump. This is the language of traders, not investors. It’s a conversation about chart patterns, not price-to-earnings ratios. The token’s trajectory is a function of market psychology, not a discounted cash flow analysis.

Ultimately, EVAA Protocol is a fascinating experiment. It has successfully captured the market's imagination by solving DeFi's most persistent problem: distribution. The integration with Telegram is a masterstroke of user acquisition strategy. But the market has priced in the most optimistic version of that story, where every Telegram user becomes a DeFi power user and the protocol prints money. The current valuation is a narrative premium. The risk is that narratives are fleeting. Once the initial hype subsides and the momentum traders move on to the next hot token, EVAA will have to stand on its own two feet, supported by its actual revenue and user activity. The data we have now is insufficient to prove it can. The platform has built a beautiful storefront in the world's busiest train station, but we still don't know if anyone is actually buying anything.

Tags: EVAA Protocol

Related Articles

Alright, let's cut the crap. Every time a new token chart goes vertical, my...

2025-10-26 29 EVAA Protocol